Actindo podiums at Best Retail Cases Awards 2023

Actindo reaches third place in the 'E-Commerce Tools' category of the Best Retail Cases Awards 2023, held this month in Cologne, Germany.

Voucher promotions, including coupons and gift cards, have become integral components of the modern shopping landscape. Deloitte reports that a substantial 68% of European consumers actively hunt for discounts and coupons to stretch their budgets amid economic turmoil, which shows that discounts actively incentivize shoppers.

Yet such schemes contain inherent tax risks that retailers are well advised to consider before launching their own scheme.

Read on for our guide to the benefits of running voucher promotions, the tax considerations to be aware of in the EU, and how to get started with your own voucher scheme.

First, let's look at a few of the main business benefits of running voucher promotions:

According to Sifted, Europe’s consumer fintechs are struggling to keep customer acquisition at a desirable level. Their customers need encouragement to download apps and other services. Coupons serve as a great incentive and entice 80% of consumers to make first-time purchases with previously unconsidered brands (RetailMeNot).

Over $1bn in gift card value goes unused annually in the U.S., showcasing their revenue potential (CEB TowerGroup). As reported by Custom Market Insights, the European Digital Gift Card Market was estimated to reach the value of USD 77.1 million in 2023. By 2032, the valuation is predicted to reach USD 273.9 million.

Coupons influence purchasing decisions for 77% of consumers and lead to a 125% increase in clicks for online sales (Inmar, Statista).

Merchants can strategically set up promotions limits to promote higher AOV, for example by setting the minimum order value or size to qualify for a promotion or launching tiered voucher promotions where the voucher grants a higher promotion tier on a bigger purchase.

According to the Understanding Loyalty in Europe Whitepaper, 59% of Germans are part of at least one loyalty program. Most, about 66%, see these programs as a great way to reward customers. Nearly half, 45%, think every brand should have one.

Brands can issue strategic promotions that discount the second and third purchase to drive repeat purchases that, in turn, make the customers more likely to purchase from the brand in the future.

Offering vouchers can be a cheaper tool to bring new customers than, for example, running paid ads. What’s more, vouchers or coupons can also be implemented as part of larger campaigns, such as loyalty programs.

According to the 2023 European Brand Loyalty Report, European consumers are willing to revisit their loyalty, with 74% saying they can be won back by brands they’ve left and 65% saying they want to receive discounts from loyalty programs.

Coupons facilitate clear ROI calculations by directly correlating with generated orders. Personalized coupon codes provide invaluable data on the customer who used the promotion.

Taxation of purchases is an important topic for all merchants. While applying VAT on a purchase of goods or services is fairly straightforward, taxing purchases where discounts or gift cards were used is not as simple.

As several of Voucherify customers and prospects based in Germany were struggling to find comprehensive materials on the topic, we dug a bit deeper into the tax regulations that relate to promotions and discounting and prepared a short overview for you to understand how to set up promotions and invoicing workflows to comply with the tax regulations in the European Union.

First, let’s explain the difference between vouchers (coupon codes) and gift card vouchers:

Gift card vouchers are amount vouchers (for example, a €50 gift voucher) that can be purchased as a product and then used as a payment method and are typically applied to the whole cart.

Promotional vouchers (also called “coupons”) are vouchers that can grant an amount, percentage, or item discount and can be applied to a specific product, line of products, or the whole cart.

As you've probably guessed by now, gift card vouchers and coupon codes have to be treated differently for tax purposes:

In the case of a discount code, the tax is calculated on the discounted product price or discounted order price.

Things get more complicated with gift card vouchers. The tax laws define two types of gift card vouchers:

A single-use gift card voucher is issued for the purchase of goods that all fall under one type of taxation, for example, all goods are taxed at a 19% VAT rate. This is the case if a company provides goods or services that all fall under one category or if the gift card voucher usage is limited to a specific product category.

Single-purpose gift cards are taxed at the issue (the issue of the voucher is a taxable transaction) so if a customer purchases a gift card voucher for €50 that is to be used for goods taxed at a 19% VAT rate, they would need to pay €59.50 for the purchase, VAT included.

Multi-purpose gift card vouchers are taxed at the redemption because nobody knows for what type of VAT rate products they will be used. Their tax is calculated per product based on the product tax rates.

If a company follows the same tax calculation and invoicing workflow for different types of vouchers and gift card vouchers, they may miscalculate the VAT and risk getting fined. What's more, selling internationally can cause the need to adapt tax rules or to limit the use of vouchers.

A merchant should follow separate tax workflows depending on the type of voucher used, specifically:

To comply with the tax regulations, a company would need to “mark” which voucher should follow a specific taxation workflow at the time of issuing that voucher, and process this information when calculating the order price and issuing an invoice.

The merchant should also prohibit using more than one gift voucher on each purchase, otherwise the tax calculation becomes very complicated.

By combining the solutions from Voucherify and Actindo, it’s possible to overcome these tax risks and workflow challenges entirely.

Voucherify supports merchants in setting up the correct workflows by enabling them to define which voucher should follow which type of tax calculation

When creating a voucher via the Voucherify Dashboard or APIs, merchants can define an additional, custom field within the metadata schema that will differentiate the type of voucher and be used to correctly assign the order to the specific workflow based on the type of voucher used.

Actindo can then process the creation of invoices and calculate the taxes per line item or per order, depending on the actual cases of a merchant. This gets realized with fully customizable workflows within the invoicing and accounting modules of Actindo, depending on what type of voucher is redeemed in the order.

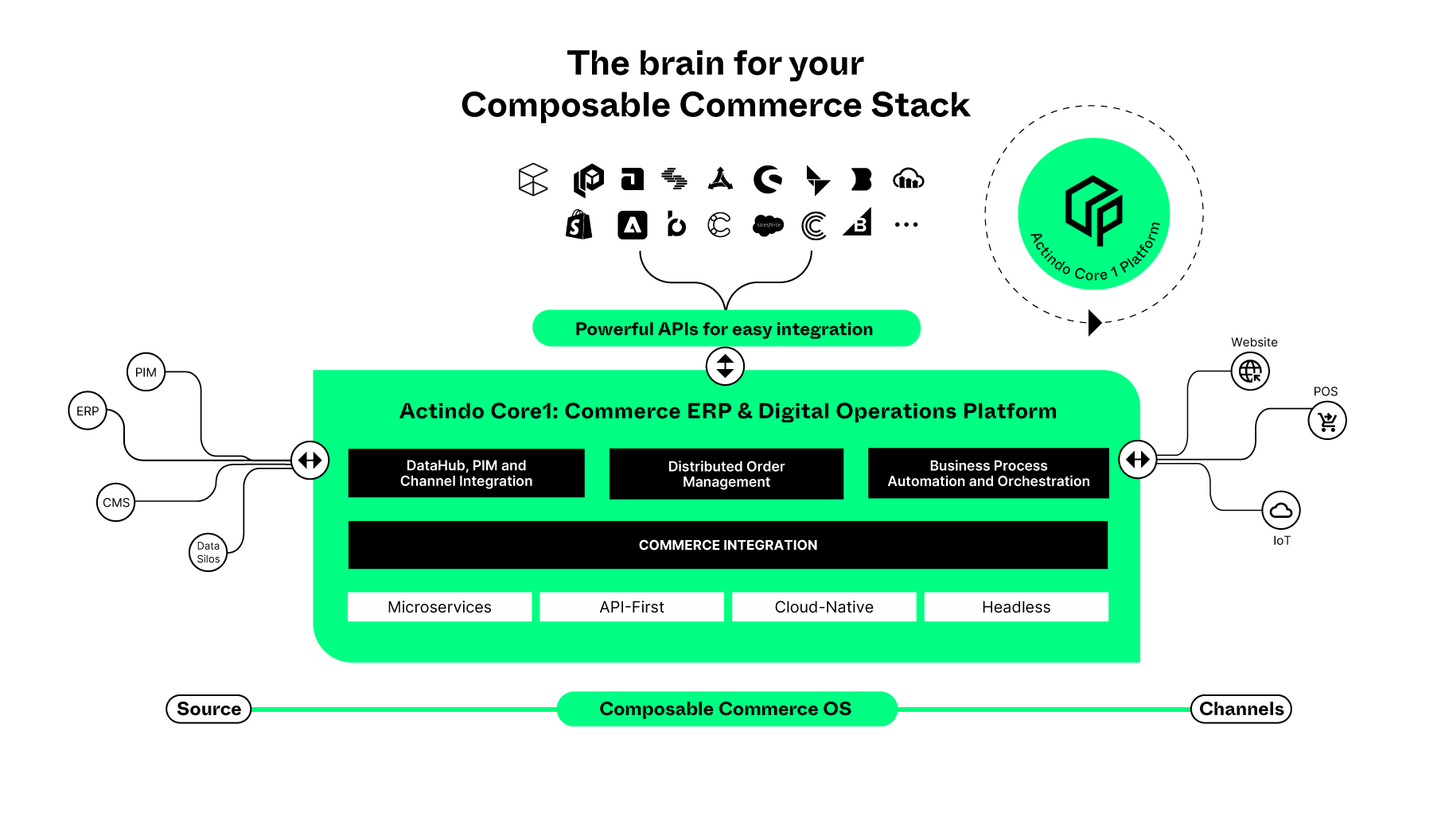

As a Commerce ERP system, Actindo centralizes and unifies data from various systems, connects 3P tools for customer engagement, customer experiences and corporate processes and helps merchants to automate their commerce processes following their actual business needs.

Voucherify is a fully flexible promotion software that makes customized, complex promotional scenarios easy to implement, manage, and track at scale.

Voucherify is an API-centric promotion engine for digital teams. It empowers marketers to quickly launch and efficiently manage promotions personalized with customer and session data, including coupons, gift cards, in-cart promotions, giveaways, referral, and loyalty programs. For more info head to www.voucherify.io.

Actindo is a global leader and pioneer in Commerce ERP technology, with more than 15 years of expertise in the market. The Actindo Core1 platform orchestrates the building blocks of composable commerce to transform, streamline and unify any digital business model.

The API-first and MACH-certified technology features built-in data organisation and distributed order management that helps brands and retailers to easily extend the platform, integrate legacy IT and deliver an outstanding digital experience across all channels.

>> Platform Overview <<

Disclaimer: The information contained in this article is provided for free, and should be used at your own risk. We recommend contacting your tax advisor before setting up the Voucherify x Actindo workflows to ensure compliance.

Info Sources include: Haufe.de / Gesetze-im-internet.de / Eur-lex.europa.eu

Actindo reaches third place in the 'E-Commerce Tools' category of the Best Retail Cases Awards 2023, held this month in Cologne, Germany.

Successful composable commerce focuses on customer needs & seamless shopping experiences. Find out how the Golden Circle methodology can help deliver...

By partnering with KPS, Actindo gains an experienced partner for the implementation of holistic customer experience solutions in e-commerce.